Responsible Investment

We aim to deliver stronger investment returns over the long term, protecting our clients’ interests through contributing to a more sustainable and resilient financial system, which supports sustainable economic growth and a thriving society

Managing systemic risk

Our approach to managing systemic risk is to leverage our role in the finance system. In partnership with our clients, we sit at the top of the investment chain. We outsource 100% of our assets under management and specialise in portfolio construction and risk management through the selection, appointment, and monitoring of asset managers. We work collaboratively with other investors, policy makers and regulators to build capacity to manage these risks and opportunities.

Brunel believes that being aware of these impacts, risks and interdependencies, and – where possible – responding to them, is a core component of fulfilling our fiduciary duty to our clients and their beneficiaries. We capture this in our stated aim (below) for our work in responsible investment and stewardship.

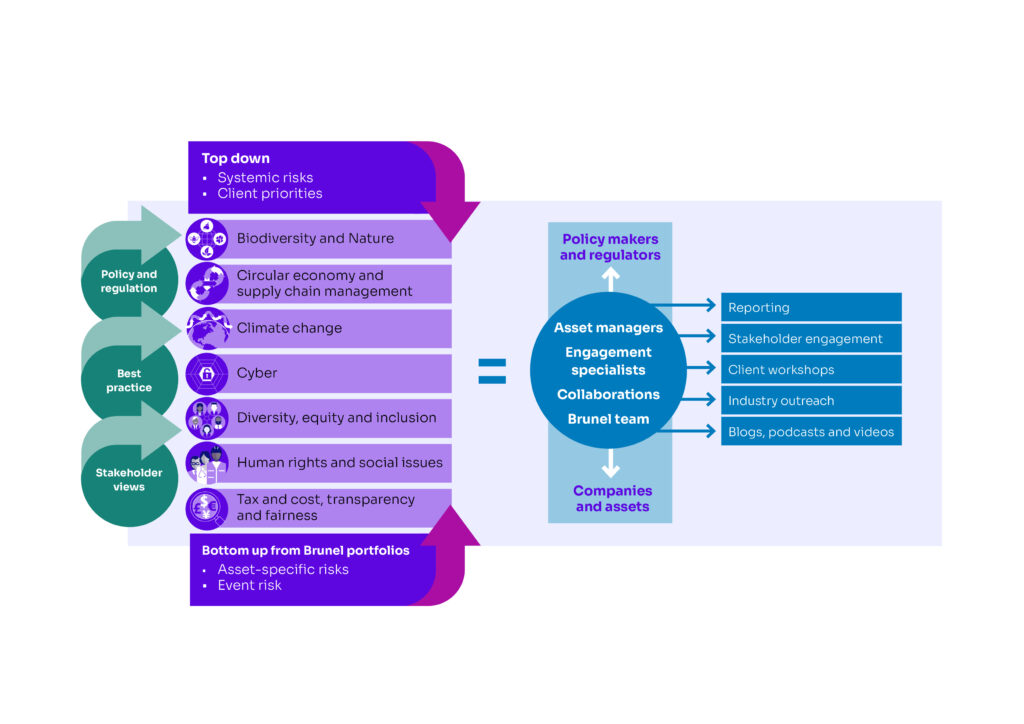

In setting our Responsible Investment and Stewardship priorities, we start with our investment principles. The priorities sit at the heart of everything we do and these are carefully developed in line with our stakeholders and ratified with external experts.

As illustrated in the diagram below, other inputs into setting Brunel’s RI priorities include an evaluation of regulations, best practice and asset specific risk (or idiosyncratic risk). Assets or sector specific risk is considered through the lens of ‘double materiality’, a concept that acknowledges financial as well as environmental, social, and governance (ESG) risks (and opportunity) of business.

Brunel RI & Stewardship Priorities

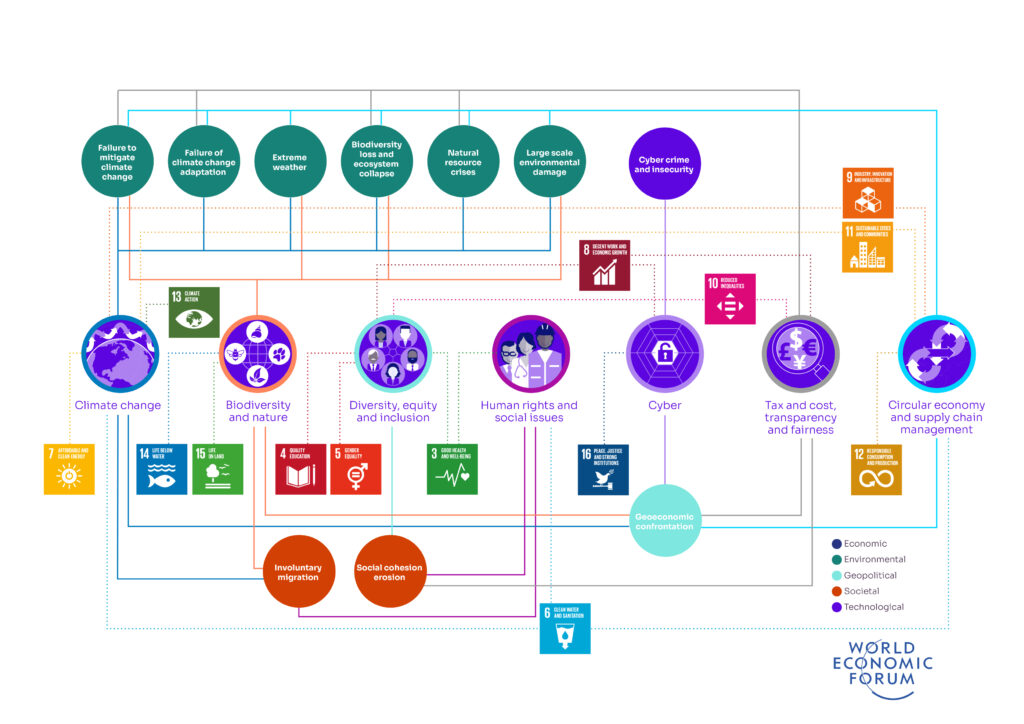

Our seven RI priorities are linked to global risks. With partnership as one of our core values, we strongly believe that problems are best tackled together. Shown below is how our RI priorities are linked to those of the fit with the Global Risks identified by the World Economic Forum, as well as the United Nations Sustainable Development goals.

A thriving society, which supports sustainable growth and allows the people and the planet to prosper is central to the seventeen Sustainable Development Goals (and 169 underlying targets) for 2030 set out in 2015 by the United Nations. We find these goals, supported by more than 150 countries and territories, a useful framework for looking at long-term sustainability risks and opportunities in investment decision making.

We address and undertake activity around each of our priorities in a different way. The following pages allow a deeper dive on each of these priorities.

Our priorities

We are a signatory of the UN backed Principles for Responsible Investment (PRI) and align our practices and processes to their six principles and definition of responsible investment.

Our approach is informed by our investment beliefs, our clients’ policies and priorities together with regulations and statutory guidance. The scope includes all our own operations (buildings, travel, people, and so on), as well as portfolio implementation and responsible stewardship. This ensures our own practices align with our expectation of the companies and assets in which we invest, that this approach is seamlessly embedded in everyday activities and that it enables everyone to contribute to forging better futures by investing for a world worth living in.

Stewardship

Effective and strategic Stewardship is an essential part of Responsible Investing. We are committed to responsible stewardship and believe that through responsible, active ownership we can contribute to the care, and long-term success, of all the assets within our remit.

We believe in being a good steward in all asset classes and apply a tailored approach appropriate to each portfolio. We also actively support the development of global stewardship best practice that will enable the effective oversight of all the companies in which we invest, including the exercise of our rights as a shareholder.

Reporting

Our annual Responsible Investment and Stewardship Outcomes Report that evaluates how we are performing against our principles and targets.

Previous reports are available in our library, along with a detailed mapping of how the report relates to the principles of the UK Stewardship Code.

Climate-related Reporting

Our climate-related reporting provides an annual update on the spectrum of activity we undertake to support our Climate Objectives. We report against the targets that we set in our Climate Change Policy. The reports also encompass the TCFD recommendations, and how we fulfil the asks of the Paris Aligned Asset Owner Commitment. More information can be found on our Climate pages.