Why the time for climate action is now

Faith Ward, Co-Chair of Transition Pathway Initiative (TPI) on behalf of the EAPF and Chief Responsible Investment Officer at Brunel Pension Partnership Limited, explains how the TPI tool can help to improve investment choices. It was originally published in Funds Europe’s ESG Report 2019.

Last year’s Special Report on Global Warming of 1.5 degrees from the Intergovernmental Panel on Climate Change warned that we have only 12 years left to avoid catastrophic climate change. Following this, a climate emergency has been declared by more than 600 cities, states and regions in 13 countries. Social, political and shareholder pressure is mounting for the corporate sector to make greenhouse gas emissions ‘net-zero’ – that is, balancing emissions with removal – by 2050.

But what is the progress of the corporate sector to date? How far is there to go?

These are the questions that the Transition Pathway Initiative’s State of Transition Report seeks to answer. The report spotlights the actions, and inactions, of the most carbon-intensive companies in public markets.

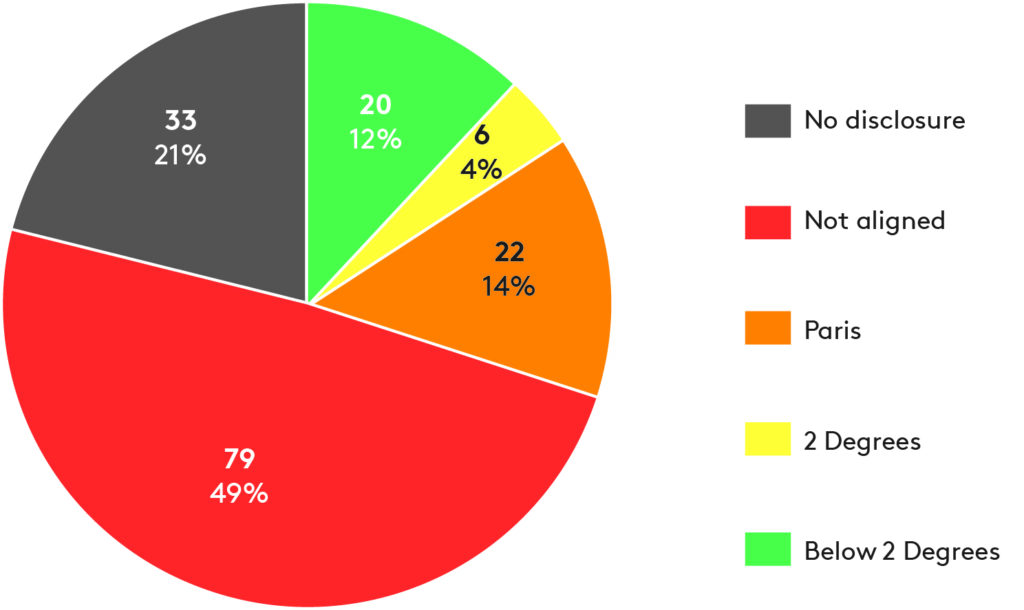

The report shows that 30% of the companies assessed – representing 160 of the world’s largest greenhouse gas emitters – are, or will be, aligned with the Paris Pledges benchmark in 2030. That is, 30% have strategies consistent with the emissions reductions pledged by Paris Agreement signatories in the form of ‘Nationally Determined Contributions’.

This is encouraging. It demonstrates that progress is being made. However, we must be clear that those pledges alone are not enough. It is widely recognised the pledges are insufficient for putting the world on track to meet the overall Paris Agreement target of keeping temperature rise well below 2°C above pre-industrial levels.

The report also clearly demonstrates that there can be huge differences within sectors in how companies are responding to the climate challenge. The emergence of clear leaders and laggards in each sector makes this an investment-relevant discussion for the global investors who must inject the trillions of dollars required for the transition to a low-carbon economy.

Carbon performance alignment with the Paris Agreement benchmarks (number and percentage of companies). Source: TPI State of Transition Report 2019

Developing expertise on climate change

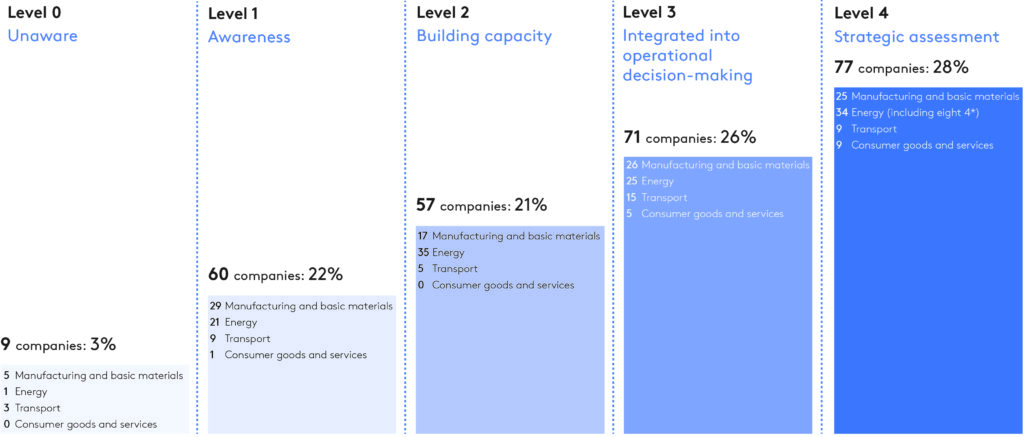

While progress on carbon performance remains an issue, the report suggests that many companies are building their capacity and expertise on climate change. These are necessary and important steps if companies are to effectively set and deliver ambitious emission reductions. For example, the report finds that:

- Among the companies assessed for the second consecutive year, 35 of 130 companies (27%) improved how they integrate climate change into their business decisions

- 46% of companies are not adequately integrating climate change into their business decisions

- 25% of companies do not disclose their own carbon emissions

- 84% of companies do not disclose an internal carbon price. 86% are yet to undertake and disclose climate scenario planning – a critical part of TCFD

- Only 16% of companies assessed for their current and planned GHG emissions are aligned with the 2°C benchmark

- Only 12.5% of companies assessed for their current and planned GHG emissions are aligned with the most ambitious below 2°C benchmark. These include E.ON, Iberdrola, Stora Enso and Edison International

Management Quality Level of all TPI companies. Source: TPI State of Transition Report 2019

Finally, the large majority of assessed companies now acknowledge climate change in their public disclosures. However, a small minority do not, and these tend to be ‘large cap’ companies in sectors significantly exposed to transition risk.

How Do we Use these Findings at Brunel?

TPI enables us to gauge the progress of our engagement programmes. Cutting through the noise, TPI distils what corporations have actually done, and what they have said they will do. Perhaps most importantly, it analyses what carbon performance outcome current corporate action leads to, and how sector peers compare.

Brunel Pension Partnership Limited (Brunel) uses TPI data to evaluate carbon transition risk of the companies in which it invests. We also use these data to identify engagement priorities and voting at AGMs.

The State of Transition offers a significant new tool in TPI’s mission to empower and equip investors to navigate the complexities of the transition to a low-carbon economy.

The conclusions that we draw from this report are clear. It is not acceptable to be a listed company highly exposed to climate risk and to fail to provide this future business-critical information to investors. The State of Transition Report, sector reports and methodologies, alongside the tool that reveals who is and who is not providing this information, is available on the free online tool.

NOTES

The Transition Pathway Initiative (TPI) is a global initiative led by asset owners and supported by asset managers, established in January 2017. Aimed at investors, it assesses companies’ progress on the transition to a low-carbon economy, supporting efforts to address climate change. Over 45 investors globally have already pledged support for the TPI. Jointly, they represent over US$14 trillion combined Assets Under Management and Advice. Using companies’ publicly disclosed data, the TPI:

- Assesses the quality of companies’ management of their carbon emissions and of risks and opportunities related to low-carbon transition, in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

- Assesses how companies’ planned or expected future Carbon Performance compares with international targets and national pledges made as part of the 2015 Paris Agreement on climate change

- Publishes the results via an open-access online tool: transitionpathwayinitiative.org

The State of Transition Report is only possible with the support of the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and Political Science, TPI’s academic partner. It has developed the assessment framework, provides company assessments, and hosts the online tool. FTSE Russell is TPI’s data partner. FTSE Russell is a leading global provider of benchmarking, analytics solutions and indices. The Principles for Responsible Investment (PRI) provides a secretariat to TPI.

My thanks to my TPI Co-chair Adam Matthews, Director of Ethics & Engagement at The Church of England Pensions Board, and the authors of the TPI State of Transition Report 2019, Simon Dietz, Rhoda Byrne, Dan Gardiner, Valentin Jahn, Michal Nachmany, Jolien Noels and Rory Sullivan, from which this article is drawn.