2025 RI & Stewardship Outcomes Report shows rapid RI advances in private markets and reporting

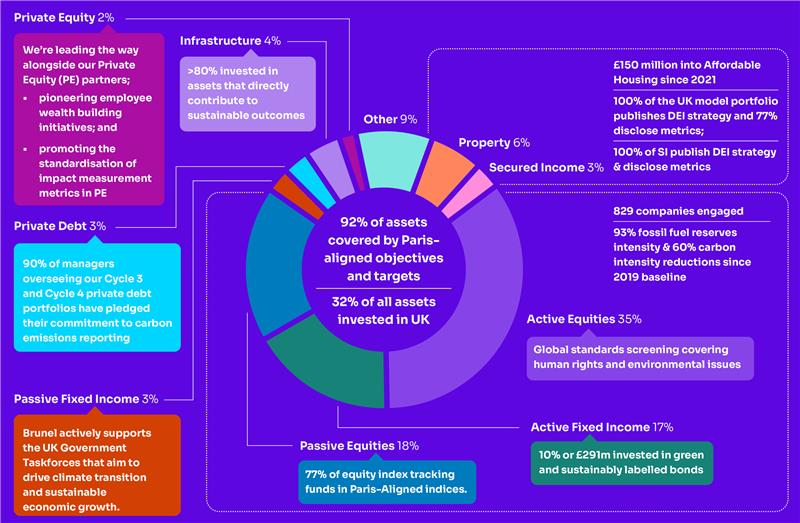

- 92% of assets now covered by Paris-aligned targets

- Choice of 3 top RI themes: Climate change, Biodiversity & Nature, Human Rights & Social Issues

- Co-authored Asset Owner Statement on Climate Stewardship ($1.5trn in initial signatories)

- 80%+ of Infrastructure investments directly contribute to sustainable outcomes

- Our Responsible Investment (RI) & Stewardship Outcomes Report 2025 is published today.

The annual report captures Brunel’s headline progress against its seven core RI priorities and in integrating RI across asset classes, exploring how the partnership improved its approach across the reporting year.

While the 2025 Report shows wide-ranging progress, we have made notable advances in tracking, reporting, and improving outcomes in private markets, where RI progress is more challenging.

“The 2025 Outcomes Report shows the exceptional range of outputs that flow from our overarching commitment to Responsible Investment and to stewardship,” said Laura Chappell, Chief Executive Officer. “Here is the proof that our partnership is showing leadership in these areas and achieving tangible results. As always, our hopes and ambitions extend beyond just Brunel, and we publish this in the hope and expectation that others will follow the same trail.”

Details are available in the two-pager summary and expanded on in the full report but private markets highlights include:

- £150m into Affordable Housing since 2021

- 100% of Secured Income investments publish DEI strategy & metrics

- 90% of managers overseeing Cycles 3 & 4 Private Debt portfolios have pledged commitment to carbon emissions reporting

The Report features interviews with:

- Bruce Duguid, Head of Stewardship, EOS, on outcomes-based reporting

- Josh Brewer, Chair of Brunel’s Responsible Investment Sub-Group, on the merits of partnership

- Tom Cottrell, Portfolio Manager, on integrating RI into risk management

It also features an in-depth profile of long-term engagement on climate change: ’10 years since aiming for ‘A’ at Shell and BP’, showing the build-up to our recently co-filed shareholder resolution.

The report also demonstrates Brunel’s continued drive for systemic change through collaborative engagements, notably through the Asset Owner Statement on Climate Stewardship.

Thematic focus

Brunel evolved its seven RI themes, selecting three as top-level themes: Climate Change; Biodiversity & Nature; Human Rights & Social Issues.

Brunel’s progress against each theme is explored and assessed in thematic sections. Case studies are provided throughout.

The two-tier system enables Brunel to prioritise key themes in line with their urgency, their need for staff focus, and with the scale of potential impact.

Impact in UK investing

The report shows that 32% of all assets are invested in the UK, ensuring that Brunel’s Responsible Investment approach impacts the domestic economy and UK society.

The UK focus also ensures that our partner funds are investing into where the great majority of their members will retire.

“The publication of our sixth consecutive Outcomes Report demonstrates our longstanding ambition to advance Responsible Investment without compromising on financial performance,” said Faith Ward our Chief Responsible Investment Officer.