Brunel Pension Partnership: Four years on

We are four years old this week!

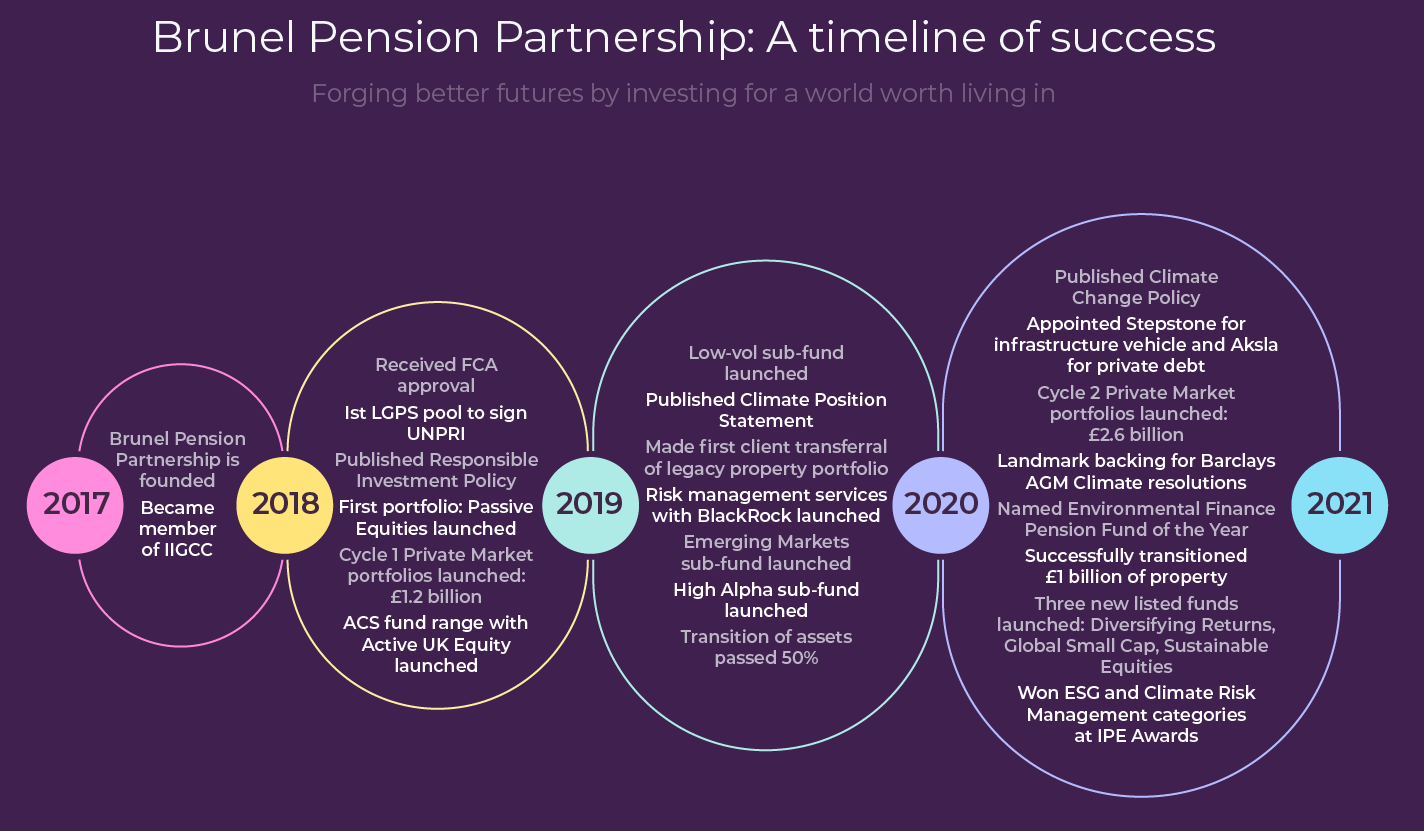

In that time, we have set up strong governance and risk management structures. We have designed, selected managers for, and launched more than a dozen funds across both public and private markets. We have transitioned more than £20 billion in funds. And we have saved our clients money – targeting £30 million a year by 2025.

We have done all this with a commitment to Responsible Investment (RI), from inception through every stage of the process. We have been willing not merely to a design RI-integrated funds and analyse our managers and holdings for their RI credentials.

We have looked at ourselves too, publishing an annual Responsible Investment & Stewardship Outcomes Report, Carbon Metrics Report and, more recently, Climate Change Action Plan (TCFD) Report. Our reputation is strong in this area as a result, especially on climate investing – as a number of major awards demonstrate. And most recently, FTSE and Brunel have launched a new series of RI benchmarks.

In our first four years, we have also hired more than 50 staff and placed ever greater emphasis on staff wellbeing – all the more so since COVID. Our flexible working policies reflect this emphasis, as do some of our recent articles.

I am enormously proud of what we have achieved together with our clients and for the world their members will one day retire in. Our broader partnership has enabled us to make rapid progress across fund launches, cost savings, governance, risk management and RI. I am enormously grateful to all our partners.

Now we look ahead to the completion of our listed fund launches, the continuation of our private market launches, and to new opportunities to provide industry leadership on RI in general, and climate change in particular.

It’s been a remarkable four years – but this is only the beginning!